UK HMRC NRL2 2011-2024 free printable template

Show details

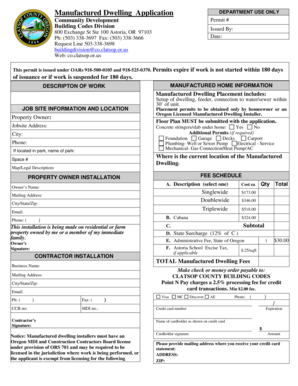

If there is more than one owner of the UK property Each owner must complete their own application form for their share of the partnership income using the appropriate form NRL1 NRL2 or NRL3. An address in the UK cannot be accepted Yes No If No please contact us before completing this form Address of registered office The company s full name Avoid abbreviations other than common ones such as Inc Co Ltd GmbH SpA and so on Country Is this the address we should send correspondence to I f No tell...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your nrl2 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nrl2 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nrl2 form online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit nrl2 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out nrl2 form

How to fill out nrl2 form:

01

Obtain the nrl2 form from the appropriate authority or website.

02

Carefully read the instructions provided on the form to ensure that you understand the requirements and information needed.

03

Begin by filling in your personal information, such as your name, address, and contact details.

04

Provide any relevant identification numbers, such as your social security number or taxpayer identification number.

05

Enter the details of the tax year for which you are completing the form.

06

Input the necessary financial information, including income, deductions, and credits.

07

Double-check all the entered information to ensure accuracy and completeness.

08

Sign and date the completed form.

09

Submit the filled-out nrl2 form to the required authority or as instructed.

Who needs nrl2 form:

01

Individuals who have earned income from sources such as self-employment, investments, or rental properties may need to fill out the nrl2 form.

02

Employees who have received income not subject to withholding taxes, such as tips or commissions, may also be required to complete this form.

03

Those who have claimed certain tax credits or deductions may need to submit an nrl2 form along with their tax return to provide additional information.

Video instructions and help with filling out and completing nrl2 form

Instructions and Help about form nrl2

Fill nrl2 form uk : Try Risk Free

People Also Ask about nrl2 form

How much tax does a non-resident landlord pay in the UK?

Do foreigners pay tax on rental income in UK?

What is NRL in HMRC?

How can I avoid paying tax on rental income UK?

What is the NRL tax in the UK?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is nrl2 form?

NRL2 form stands for Non-Resident Landlord Tax Return. It is a form that non-resident landlords in the UK must fill out in order to pay the tax they owe on their rental income.

What is the purpose of nrl2 form?

The NRL2 form is used by employers to tell HMRC about National Insurance contributions (NICs) due on payments made to workers who are not employed by them. This form is usually used for employers who need to make payments to contractors, subcontractors, agency workers or other workers who are not employed by them.

When is the deadline to file nrl2 form in 2023?

The deadline to file NRL2 form for the 2023 tax year has not yet been announced. Generally, the deadline for filing NRL2 form is the same as the due date of filing your income tax return.

Who is required to file nrl2 form?

The NRL2 form is required to be filed by non-resident individuals or foreign nationals who have income in India and want to claim relief under the Double Taxation Avoidance Agreement (DTAA) between India and their home country.

How to fill out nrl2 form?

To fill out an NRL2 form, which is required for individuals who want to claim back national insurance that was paid while working abroad, you need to follow these steps:

1. Obtain the form: You can download the NRL2 form from the official website of the UK government or request a copy by calling the helpline of Her Majesty’s Revenue and Customs (HMRC).

2. Provide personal details: Fill in your personal information, including your full name, current address, National Insurance number, and contact details.

3. Employment details: Fill in the details of your employment abroad, such as the name of the foreign country, employer's name and address, dates of employment, and your job title.

4. Earnings and deductions: Enter the total amount of earnings you received during your employment abroad and the amount of national insurance contributions deducted from your salary.

5. Supporting documents: Gather supporting documents to accompany your application, which might include payslips, tax documents, or any other evidence of your employment and national insurance contributions.

6. Declaration and signature: Read the declaration carefully and sign and date the form to confirm the information provided is accurate and truthful.

7. Submit the form: Once you have completed the NRL2 form and gathered all necessary supporting documents, send it to the HMRC address mentioned on the form. Make sure to make copies of the form and documents for your records.

It is recommended to check the guidance notes provided with the NRL2 form for specific instructions or consult with a tax professional if you have any doubts or questions.

What information must be reported on nrl2 form?

The NRL2 form, also known as the Non-Residential Landlord Notification Form, is used by non-residential landlords in the United Kingdom to provide certain information to HM Revenue and Customs (HMRC). The information that must be reported on the NRL2 form includes:

1. The landlord's personal details:

- Name

- Address

- National Insurance number (or Unique Taxpayer Reference number, if applicable)

- Telephone number

- Email address

2. The property details:

- Address of the property being let

- Completion date of the building (if known)

- Date the tenant(s) occupied the property

- Date the property was first commercially let (if known)

- Description of the property, e.g., office, shop, warehouse, etc.

3. Tenancy information:

- Name(s) and address(es) of the tenant(s) currently occupying the property

- Start date of the current tenancy

- Tenancy agreement details, such as lease term, rent amount, and any rent-free periods (if applicable)

4. Agent details (if applicable):

- Name and address of the letting or managing agent, if the landlord uses one

- Address of the agent's office or principal place of business (if different from the landlord's address)

It's important to note that additional supporting documentation may be required, such as a copy of the tenancy agreement or lease.

The NRL2 form should be submitted to HMRC within 30 days of the date the non-residential lease or tenancy agreement is entered into, or the property is occupied by a new tenant, whichever event occurs first.

What is the penalty for the late filing of nrl2 form?

The penalty for late filing of NRL2 form can vary depending on the country or jurisdiction. In the United Kingdom, for example, the penalty for late filing of NRL2 form is currently £100 for the first 3 months of delay, followed by an additional £10 per day after 3 months, up to a maximum of £900. However, it is important to note that these penalties might change over time, so it is advisable to consult the specific regulations and guidelines provided by the tax authority in your jurisdiction.

Can I sign the nrl2 form electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your nrl2 form in minutes.

How do I fill out nrl1 form no download needed using my mobile device?

Use the pdfFiller mobile app to fill out and sign print cwf1 form pdf on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit nrl1 tax form on an iOS device?

Create, edit, and share nrl2 hmrc form from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

Fill out your nrl2 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

nrl1 Form No Download Needed is not the form you're looking for?Search for another form here.

Keywords relevant to nr4 form

Related to nrl2 form no download needed

If you believe that this page should be taken down, please follow our DMCA take down process

here

.