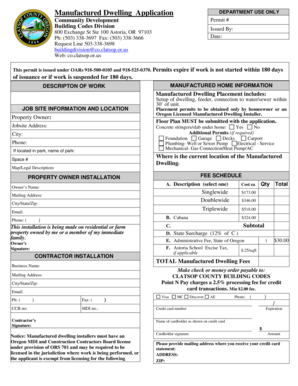

UK HMRC NRL2 2011-2025 free printable template

Show details

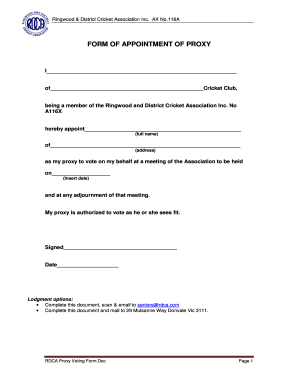

If there is more than one owner of the UK property Each owner must complete their own application form for their share of the partnership income using the appropriate form NRL1 NRL2 or NRL3. An address in the UK cannot be accepted Yes No If No please contact us before completing this form Address of registered office The company s full name Avoid abbreviations other than common ones such as Inc Co Ltd GmbH SpA and so on Country Is this the address we should send correspondence to I f No tell...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nrl2 form

Edit your uk nrl2 application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form nrl2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nrl2 pdf online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit uk hmrc nrl2 is a income without tax being deducted form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nrl2 rental income form

How to fill out UK HMRC NRL2

01

Obtain the UK HMRC NRL2 form from the HMRC website or relevant office.

02

Fill in your personal details, including your name, address, and National Insurance number.

03

Provide information about your foreign income and confirm your residency status.

04

Indicate the tax year for which you are submitting the form.

05

Review the completed form to ensure all information is accurate and complete.

06

Submit the form to HMRC either online or by post, depending on your preference.

Who needs UK HMRC NRL2?

01

Non-resident landlords who rent out property in the UK.

02

Individuals who earn income from UK property and wish to claim certain allowances.

03

People seeking to apply for the non-resident landlord scheme.

Fill

nrl2 rental tax

: Try Risk Free

People Also Ask about form nrl2 hmrc

How much tax does a non-resident landlord pay in the UK?

Non-resident landlords should also file a UK Tax Return with HMRC at the end of each tax year to report taxable profit/loss.Income tax payable on UK property income. Income tax bandIncome tax rate£0 to £31,785Basic rate20%£31,786 to £150,000Higher rate40%Over £150,000Additional rate45%

Do foreigners pay tax on rental income in UK?

You need to pay tax on your rental income if you rent out a property in the UK. You may also need to pay tax if you make a gain when you sell property or land in the UK.

What is NRL in HMRC?

Call HMRC for help and advice and for more information about the Non-resident Landlord (NRL) scheme. Telephone: 0300 322 9433. Outside UK: +44 300 322 9433.

How can I avoid paying tax on rental income UK?

There are a number of different ways to reduce income tax on rental property and these include: Assign beneficial interest to use the tax allowance of your spouse using a Form 17. Transfer the buy to let into a Limited Company. Offset allowable expenses to reduce tax bill on rental income.

What is the NRL tax in the UK?

What is the Non-Resident Landlord Scheme (NRLS)? The NRLS is a scheme to tax the UK rental income of persons who have a usual place of abode outside the UK – known as non-resident landlords. The NRLS imposes obligations on the tenant or the letting agent (if there is one).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the form nrl2 application electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your nrl 2 in minutes.

How do I fill out nrl2 0 using my mobile device?

Use the pdfFiller mobile app to fill out and sign non resident landlord hmrc contact number on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit nrl forms on an iOS device?

Create, edit, and share hmrc forms from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is UK HMRC NRL2?

UK HMRC NRL2 is a form used by non-resident landlords in the UK to apply for the Non-Resident Landlord Scheme, which allows them to receive rental income without tax being deducted.

Who is required to file UK HMRC NRL2?

Non-resident landlords who wish to receive their rental income without tax deductions are required to file the UK HMRC NRL2 form.

How to fill out UK HMRC NRL2?

To fill out the UK HMRC NRL2 form, landlords need to provide personal details, property information, and bank account details for where the rental income should be paid.

What is the purpose of UK HMRC NRL2?

The purpose of UK HMRC NRL2 is to allow non-resident landlords to obtain approval to receive rental income without tax being automatically deducted at source.

What information must be reported on UK HMRC NRL2?

The information that must be reported on UK HMRC NRL2 includes the landlord's name, address, date of birth, property address, and bank account details for rental income payments.

Fill out your UK HMRC NRL2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

0300 322 9433 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.